Helping You Invest in Multifamily Real Estate

$170M+

assets under management

638

Multifamily units acquired

15-20%

Projected annual returns

About Us

At Faris Capital Partners, our mission is to go Full Out® to help real estate investors invest in multifamily apartments in the United States.

Our goal is to get premium returns for our Canadian and American investors and help you build mega wealth. We provide first class service and make it super easy for you to invest in real estate.

We are experts at finding great apartment deals and partnering with investors to raise capital. We then acquire, renovate, optimize rental income, and ultimately resell apartment buildings, maximizing investor returns at every stage.

Choose Faris Capital Partners as your trusted partner in your wealth-building journey and let us help you unlock the true potential of the United States’ multifamily real estate market.

Our Core Values

How it works

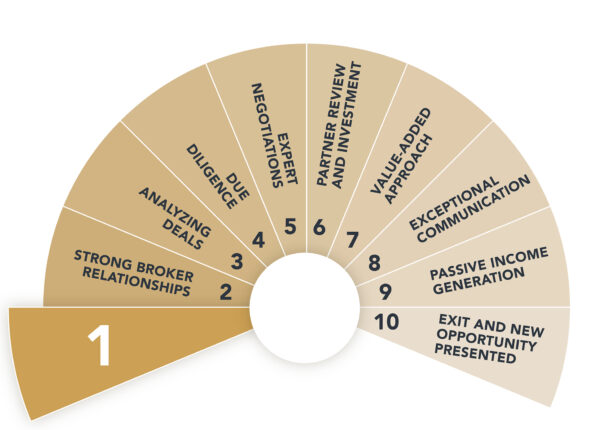

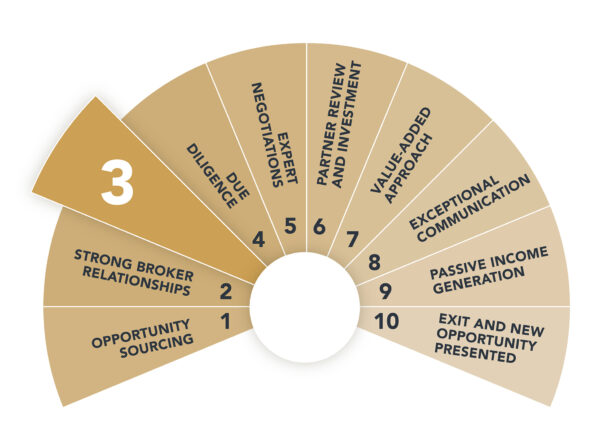

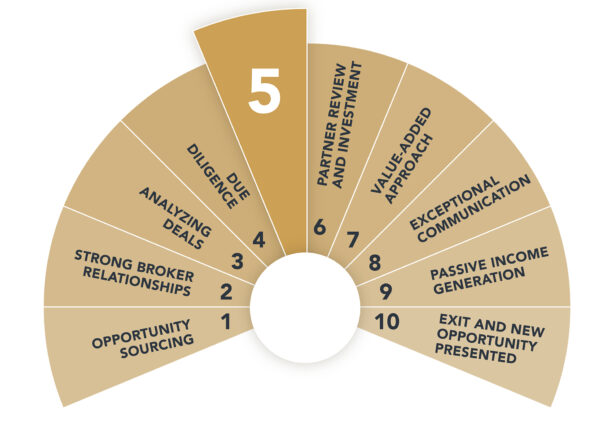

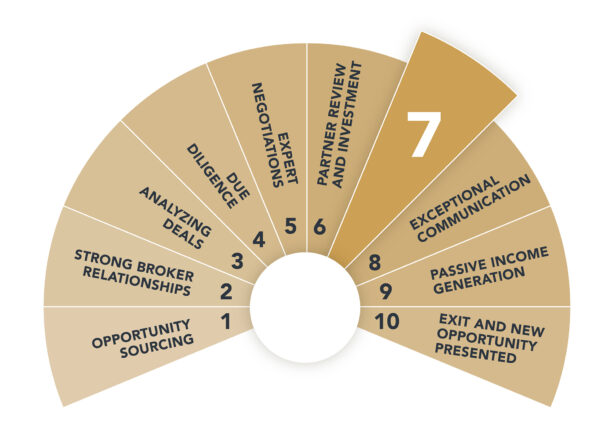

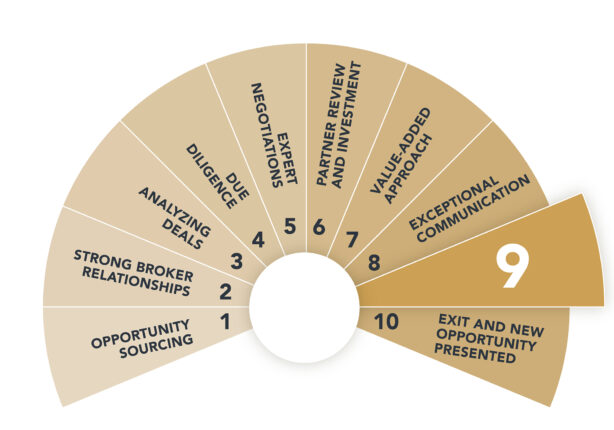

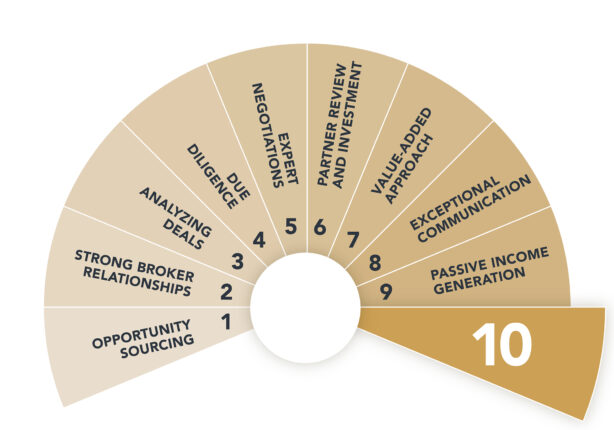

10-Step Full Out® Investing System

Opportunity Sourcing

We leverage best-in-class market research to determine the markets and neighborhoods that will generate the most value for our investors. We look for markets with net population growth, above-average household income, job growth across various sectors, along with rent growth and real estate price appreciation. Investing in emerging markets positions you to have the greatest upside.

Step 1

Strong Broker Relationships

We build strong relationships with real estate Brokers serving the markets that we invest in. Through these strong relationships, we receive a steady flow of on and off-market opportunities giving us an edge in finding the best apartment deals.

Step 2

Analyzing Deals

We leverage cutting-edge technologies, allowing us to fully analyze and underwrite potential apartment deals. We only pursue the best deals that have significant upside with value-add renovations, that match our business plan and our investor goals.

Step 3

Due Diligence

We conduct thorough measures of due diligence with every transaction to minimize risk and maximize returns. Once we have identified potential deals that meet our investment criteria, our team personally visits each apartment building alongside our trusted industry partners. We then perform an extensive audit of all property financials. Then we conduct property inspections and work alongside our construction team to validate our business plan. We also source the best lender terms and insurance premiums during the due diligence phase.

Step 4

Expert Negotiations

Building upon our experience negotiating thousands of real estate deals, our team of negotiation experts always go full out® for our investors to negotiate a great deal with substantial upside. Our priority is getting you the best deal possible to help you build mega wealth faster.

Step 5

Partner Review and Investment

Once we have completed our extensive, proven due diligence process, we present the opportunity to potential investor partners. We walk investor partners through our business plan, going in-depth on all key points of the deal. We offer a first-class experience, including presentation of our business plan, webinars, one-on-one calls and zoom meetings. From here, we make a mutual decision to become partners and work together on the select apartment deal.

Step 6

Value-Added Approach

Our goal is to add value to our investments through property improvements that generate additional income while lowering expenses. Speed of execution is one of our values, therefore we begin property improvements on the day of closing so that we can hit the ground running. In fact, we have developed the “Full Out 28 Day Transformation” system where we commit to specific renovation targets for instant impact in the community. In addition to visiting the property regularly, we execute our business plan working with our industry partners such as property managers and the construction team to ensure all progress stays on track.

Step 7

Exceptional Communication

It’s important to us to keep our investor partners informed about how their wealth is growing. You will be updated monthly on the progress of your investment, removing any of the guesswork when it comes to knowing exactly how your investment is working for you. We are transparent on what is happening and communicate with clarity so that you understand everything on an ongoing basis. We guarantee to send you a progress update on the 30th of each month otherwise we buy you a steak dinner.

Step 8

Passive Income Generation

Cash flow is always top of mind at Faris Capital Partners. We target investments where cash distributions continue to our investor partners, even while the renovations are in progress. Our goal is to provide monthly distributions for our partner investors within 3-6 months of acquisition. We want you to enjoy the benefits of passive income throughout your investment term.

Step 9

Exit and New Opportunity Presented

In a typical investment, we target a 3–5-year exit. We leverage our experience, data and proven strategy to target the ideal time to sell the apartment building to maximize your returns. Our goal is to provide such an incredible experience that you invest with us again and again!

Step 10

Opportunity Sourcing

We leverage best-in-class market research to determine the markets and neighborhoods that will generate the most value for our investors. We look for markets with net population growth, above-average household income, job growth across various sectors, along with rent growth and real estate price appreciation. Investing in emerging markets positions you to have the greatest upside.

Step 1

Strong Broker Relationships

We build strong relationships with real estate Brokers serving the markets that we invest in. Through these strong relationships, we receive a steady flow of on and off-market opportunities giving us an edge in finding the best apartment deals.

Step 2

Analyzing Deals

We leverage cutting-edge technologies, allowing us to fully analyze and underwrite potential apartment deals. We only pursue the best deals that have significant upside with value-add renovations, that match our business plan and our investor goals.

Step 3

Due Diligence

We conduct thorough measures of due diligence with every transaction to minimize risk and maximize returns. Once we have identified potential deals that meet our investment criteria, our team personally visits each apartment building alongside our trusted industry partners. We then perform an extensive audit of all property financials. Then we conduct property inspections and work alongside our construction team to validate our business plan. We also source the best lender terms and insurance premiums during the due diligence phase.

Step 4

Expert Negotiations

Building upon our experience negotiating thousands of real estate deals, our team of negotiation experts always go full out® for our investors to negotiate a great deal with substantial upside. Our priority is getting you the best deal possible to help you build mega wealth faster.

Step 5

Partner Review and Investment

Once we have completed our extensive, proven due diligence process, we present the opportunity to potential investor partners. We walk investor partners through our business plan, going in-depth on all key points of the deal. We offer a first-class experience, including presentation of our business plan, webinars, one-on-one calls and zoom meetings. From here, we make a mutual decision to become partners and work together on the select apartment deal.

Step 6

Value-Added Approach

Our goal is to add value to our investments through property improvements that generate additional income while lowering expenses. Speed of execution is one of our values, therefore we begin property improvements on the day of closing so that we can hit the ground running. In fact, we have developed the “Full Out 28 Day Transformation” system where we commit to specific renovation targets for instant impact in the community. In addition to visiting the property regularly, we execute our business plan working with our industry partners such as property managers and the construction team to ensure all progress stays on track.

Step 7

Exceptional Communication

It’s important to us to keep our investor partners informed about how their wealth is growing. You will be updated monthly on the progress of your investment, removing any of the guesswork when it comes to knowing exactly how your investment is working for you. We are transparent on what is happening and communicate with clarity so that you understand everything on an ongoing basis. We guarantee to send you a progress update on the 30th of each month otherwise we buy you a steak dinner.

Step 8

Passive Income Generation

Cash flow is always top of mind at Faris Capital Partners. We target investments where cash distributions continue to our investor partners, even while the renovations are in progress. Our goal is to provide monthly distributions for our partner investors within 3-6 months of acquisition. We want you to enjoy the benefits of passive income throughout your investment term.

Step 9

Exit and New Opportunity Presented

In a typical investment, we target a 3–5-year exit. We leverage our experience, data and proven strategy to target the ideal time to sell the apartment building to maximize your returns. Our goal is to provide such an incredible experience that you invest with us again and again!

Step 10

CURRENT DEALS

Check Out Our Deals

FREE Full Out® 7-Day Multifamily Wealth-Building Investment Course

Learn the ins and outs of multifamily investing with Mark Faris with lessons delivered to your inbox daily.

Why It’s Wise to Invest in Multifamily Real Estate

Lower Risk than Single Homes or Lower-Unit Apartments.

If a tenant moves out of a 100-unit apartment building it’s not a big deal since you have income from the other tenants still coming in, whereas if a tenant moves out of a single-family home you lose 100% of its income, where a duplex loses 50% and so on. The more units you have the more insulated you become, and the less tenant turnover affects you.

1/12

Apartments are Rare

There is a lot of money out there hunting for high return investments. Apartment buildings are rare, and “big money” billion-dollar institutional companies are chasing these very same assets as we are, which drives prices even further. Commercial real estate brokers say that a solid apartment deal could have hundreds if not thousands of interested buyers, which is why these deals are typically private and not posted on an MLS type of system.

2/12

Increasing in Demand

Demand for apartments is at an all-time high as there is a limited supply of lower income housing. There are simply not enough homes to support our growing population, and that’s going to continue to add more pressure to real estate prices going up in the future. With the rise of home prices and interest rates, it’s becoming more difficult to own a home than ever. Low vacancy rates equal greater cash flow as well as equity growth, which translates to higher returns for our investors.

3/12

Economies of Scale

Operating a 100-unit multifamily apartment is less expensive than operating 100 single family rentals. One roof, one heating system, one yard to maintain, all in one location. Property management companies may charge 10% to manage a single-family home, whereas in a 100+ unit, they charge a bulk-discount of around 3%. This drives returns, provides excellent service, and promotes a strong community in one location.

4/12

More Predictable, Income-Based Valuations

Apartment building values are based on income; not neighboring sales like in single-family housing. You can predict what you can sell for, as values are based on an apartment’s NOI (Rental Income minus Operating Expenses = Net Operating Income). We focus on forced appreciation through renovations. For every $1 we increase income or decrease expenses, we force the value of the apartment building up by $20. If we raise rent in a 100-unit apartment building by $100 per unit, it will add $10,000 – $120,000 per year additional rental income, increasing the value of the building by $2.4 million dollars ($120,000 x 5% CAP Rate = $2.4 Million value). That’s huge! This also increases your net worth as an investor.

5/12

Cashflow and High Return on Investment

In Florida we buy properties that will return 5-7% cashflow distributions on a monthly or quarterly basis to our investors, plus a large payment once we renovate and sell the apartment building. So for example, if an investor partner invests $500,000 on a deal, they would receive approximately $25,000-$35,000 annually until we sell the property. At that point they would receive their original investment of $500,000 back, plus their share of the profits from the sale of the building, typically 10-13% of the original investment, so another $50,000-$65,000.

6/12

Income Generating Physical Asset

Apartments give you more control of the investment. Your investment is backed by an income generating asset, so not only do you benefit from the asset going up in value you are also receiving cashflow, even in a struggling market. Real estate is also a great Inflation hedge. There are trillions of dollars being printed into the money supply, making each dollar worth less every day. Buying physical assets has always been the best way to protect wealth in an inflationary market.

8/12

Leverage

With Real Estate you can also leverage an asset that’s 5x greater than your investment by getting a mortgage through a bank. With 20% down payment and 80% mortgage, a property that goes up 5% in market value, will get you a 25% return on your invested money. That’s the power of leverage!

9/12

Proven vehicle

Andrew Carnegie was the richest man in the world in the 1800’s, he famously said that 90% of the world’s millionaires used real estate to build their wealth, and that still holds true today. If you look at your own net worth, there’s a high probability that a good portion of it is currently in real estate. If that is true for you, then why not do more of what’s already working for you, right?

11/12

For Canadians: U.S. Diversification

Purchasing apartments in Florida allow you to diversify your investments benefiting from the US dollar, which is the world’s reserve currency. The distributions you receive are in US dollars, so when you go visit the US you don’t have to pay high fees for the exchange. By the way, we get our Canadian investor partners access to exchange CAD to USD exchange rates at 0.25%, whereas the big banks take 1.25% or higher on exchanges but blend it into the rate they quote so you don’t see it.

12/12

Ready to connect?

Book a call with our investor relations team today to learn more about current investment opportunities.

Have a question?

Please use the form below to contact us. We will never spam you, or sell your email to third parties.