Is Passive Real Estate Investment the Right Option for Your Portfolio?

|

FEBRUARY 16, 2024

|

Introduction:

Investors can enjoy consistent cash flow through passive commercial real estate investment, avoiding the complexities of property management or development. This approach enables investors to diversify their portfolios extensively.

Passive real estate investing refers to a strategy in which an investor allocates funds into a real estate venture without actively participating in the daily management or decision-making processes regarding the property or properties involved.

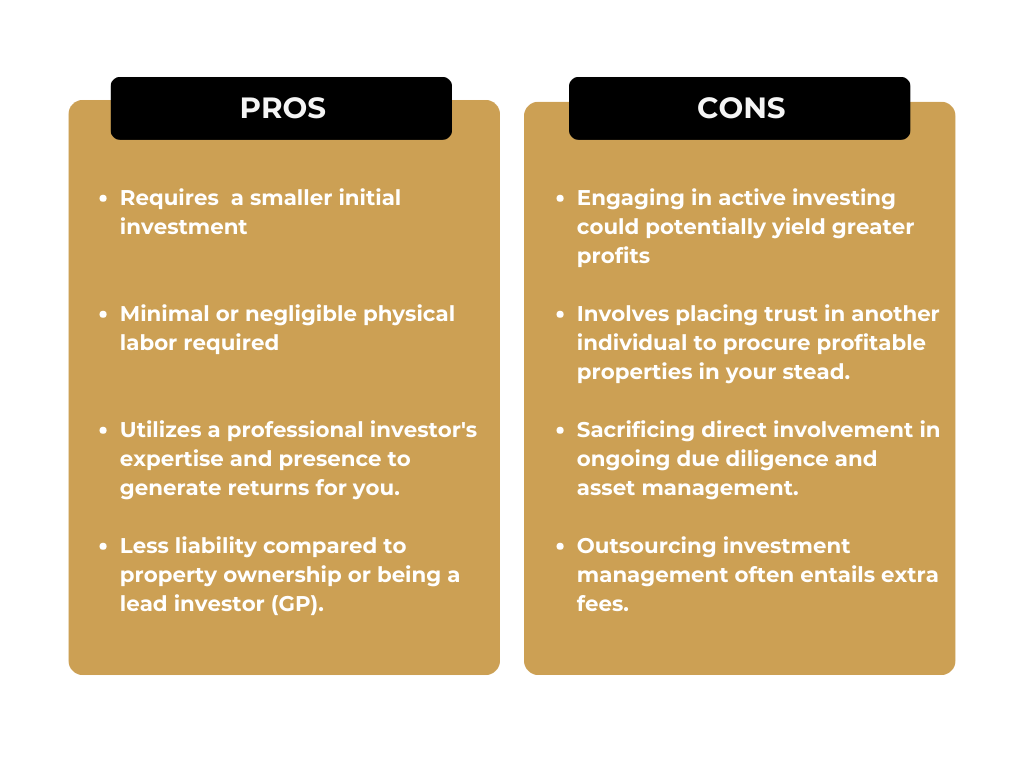

Collaborating with a sponsor or management company entails certain risks and considerations. Presented below are the primary advantages and pitfalls of passive real estate investing that both non-accredited and accredited investors should take into account.

Advantages of Passive Real Estate Investing:

Passive real estate investment opportunities are accessible to individuals through avenues like real estate investment trusts or direct real estate platforms such as Faris Capital Partners, providing access to exclusive direct private market assets. Beyond simply offering uncorrelated returns, passive real estate investing offers numerous benefits. Here are some of the advantages associated with this highly sought-after investment strategy:

– Reduced entry barriers: For instance, passive real estate investing through Faris Capital Partners starts at just $100,000, with no obligation to purchase entire multifamily apartments.

– Minimal physical labor: Investing in passive real estate ventures requires little to no physical exertion. Through collaboration with a sponsor, investors can avoid the time and energy spent on tenant vetting, property maintenance, or real estate marketing.

Leveraging professional expertise: Working with sponsors who possess on-the-ground expertise allows investors to tap into the knowledge of seasoned professionals. With direct real estate platforms like Faris Capital Partners, professional investors work behind the scenes to generate returns on behalf of investors.

– Reduced liability: Passive investors face lower liability when working with a general partner (GP) or sponsor. In passive investment scenarios, investors typically only need to manage investment capital addition and expect updates and return payouts, while the GP handles the operational aspects.

Throughout history, private real estate has demonstrated lower volatility compared to the S&P 500, rendering passive real estate investing an appealing strategy for wealth accumulation. Additionally, investors can leverage distinctive tax advantages while diversifying their portfolios.

Drawbacks and Risks of Passive Real Estate Investing

Despite its designation, passive real estate investing may not always be entirely hands-off. This investment approach remains susceptible to typical commercial real estate risks, such as vacancies. Here are several other risks associated with passive real estate investing:

– Active investing potentially offers higher profit prospects compared to passive strategies. With active real estate investing, you have complete control over your investment. The physical effort and time invested in acquiring and renovating properties can yield greater returns compared to passive real estate investment facilitated by a sponsor.

– While not always necessary, entrusting a sponsor to procure properties on your behalf entails relinquishing some decision-making authority to a professional investor overseeing multiple portfolios. Opting for a hands-on approach to commercial real estate (CRE) property acquisition makes passive real estate investing less passive.

– Typically, you won’t be the primary contact for your passive real estate investment property. Consequently, if any issues arise with your real estate, a team of others will handle them promptly and responsibly. This adjustment might be challenging for investors accustomed to full control.

– Engaging someone else to manage your real estate investment incurs additional fees. These fees, common in passive real estate investment, can accumulate rapidly. However, they compensate for the convenience and expertise offered by passive real estate investing.

Are you comfortable entrusting your real estate investment portfolio to seasoned professional investors? If so, passive real estate income generation might suit you, and these considerations might not appear as drawbacks. Regardless of the level of passivity in your real estate investments, it’s essential to comprehend the underlying structure of your investment. Your investment platform may offer varying levels of intermediary diligence, asset management, or structuring.

Passive real estate investing extends beyond mere structure; it encompasses the expertise of the professionals managing your investment.

With Faris Capital Partners, accredited investors can participate in multifamily apartment ventures without the burdens of landlordship. Our seasoned Real Estate Team meticulously evaluates each opportunity and rigorously vets all sponsors. However, we always recommend conducting your due diligence.

If you wish to assess the potential returns, fee structures, and investment minimums of various passive real estate investment options, we encourage you to reach out to our Investor Relations Team for further information or visit us at https://www.fariscapitalpartners.com/

Interested in learning more about Multifamily Apartment Investing? Download our FREE E-book – The Full Out Apartment Investor

Ready to connect?

Book a call with our investor relations team today to learn more about current investment opportunities.

Have a question?

Please use the form below to contact us. We will never spam you, or sell your email to third parties.